Independent Advisors

Are You Independent?

Annual Audit

FA Ownership - Client will transfer accounts (ACATs) if you change firms.

(3) Poor Service

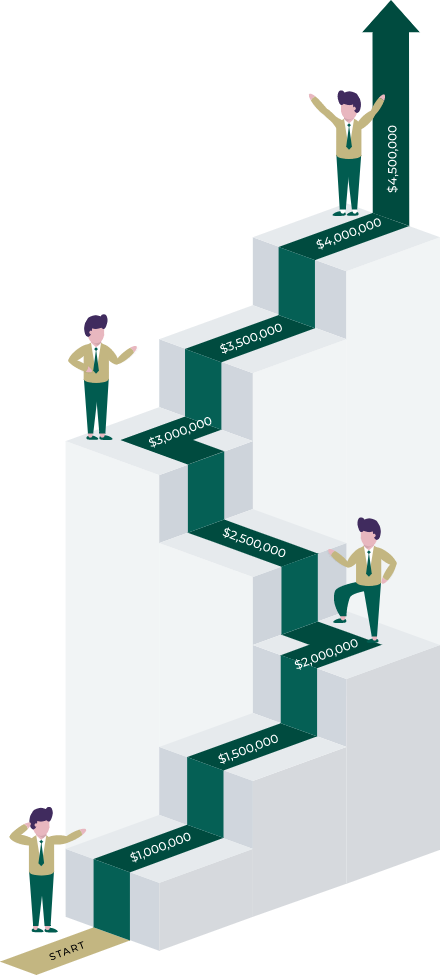

Independence = Growth

1099 Income Statement

Two Financial Advisors & Two Client Associates

Top-Line Revenue

$3,000,000

Minus Expenses

$1,180,000

Equals Net Income

$1,820,000

Divided by Revenue

$3,000,000

Equals Payout

60%

Selling "The Book" at Retirement

Two Choices

- Inhouse Sale

- Open Market Sale

Model of Profitability

- EBITDA: Earnings before Interest, Taxes, Depreciation & Amortization

Market Multiple Range (as of 2024)

- 5 to 12 (depending on size and quality of book)

Taxes

- Long Term Capital Gains vs. Ordinary Income Taxes

Example (Hypothetical for Illustrative Purposes Only)

- Big 4 Inhouse Program

Revenues 3,000,000

Deal 250%

Revenue 7,500,000

Payout 45%

W-2 3,375,000

Ordinary Income Tax 35%

Net 2,193,750

- Independent Channel

Revenues 3,000,000

EBOC 65%

EBITDA (%) 35%

EBITDA ($) 1,050,000

Multiple (x) 10

Price 10,500,000

LT Cap. Gains 20%

Net 8,400,000

- Independent Premium 6,206,250